The Bollinger Bands Squeeze strategy is a powerful volatility-based trading method used to identify explosive breakout opportunities in Forex markets. When price volatility contracts and the bands narrow, it often signals that a strong move is approaching. With Exness offering tight spreads, fast execution, and advanced trading platforms, this strategy becomes especially effective for traders seeking high-probability breakout setups in global markets.

What Is the Bollinger Bands Squeeze Strategy?

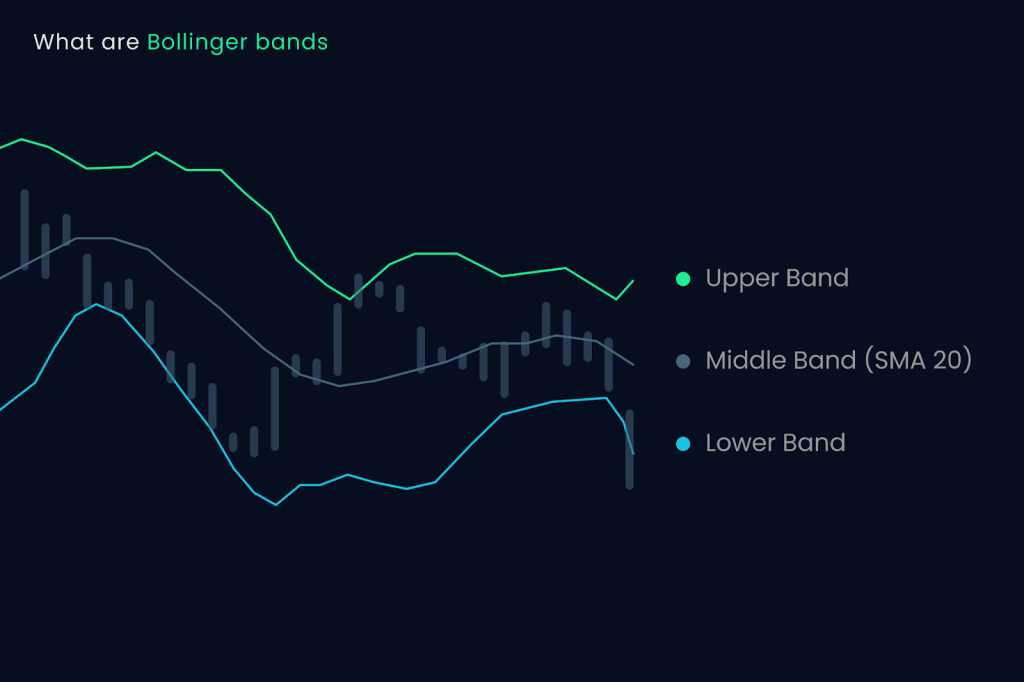

The Bollinger Bands Squeeze strategy focuses on periods of unusually low volatility. Bollinger Bands consist of three lines: a middle moving average, an upper band, and a lower band. When the distance between the upper and lower bands becomes very narrow, the market is said to be “in a squeeze.”

This compression phase usually precedes a sharp price expansion, making it a valuable signal for breakout traders.

Why Volatility Contraction Matters

Financial markets alternate between low and high volatility. A squeeze indicates that buying and selling pressure are temporarily balanced. Once this balance breaks, price often moves rapidly in one direction.

On Exness (エクスネス), where execution speed and pricing stability are optimized, traders can react quickly when volatility expands.

How Bollinger Bands Are Calculated

Understanding the mechanics behind Bollinger Bands helps traders apply the squeeze strategy more effectively.

Components of Bollinger Bands

Bollinger Bands are built using:

- A moving average, typically a 20-period SMA

- Upper band: moving average plus two standard deviations

- Lower band: moving average minus two standard deviations

Standard deviation measures volatility, which is why band width changes dynamically based on market conditions.

Identifying a True Squeeze

A true squeeze occurs when the bands contract to historically narrow levels relative to recent price action. This can be visually confirmed on MT4 or MT5 charts provided by Exness.

Traders often compare current band width with previous squeezes to assess breakout potential.

How to Trade the Bollinger Bands Squeeze

The squeeze itself is not a trade signal. It is a warning that volatility is about to increase. Proper execution requires confirmation and discipline.

Step One: Spot the Squeeze

Look for a prolonged period where Bollinger Bands are tightly compressed and price moves in a narrow range. This often occurs during low-volume sessions or before major news events.

Exness traders benefit from real-time charts and low-latency pricing, allowing precise squeeze identification.

Step Two: Wait for Breakout Confirmation

A breakout occurs when price closes decisively outside the upper or lower band with increased momentum. Volume expansion or strong candlestick patterns can confirm the move.

Avoid entering trades before the breakout, as premature entries often result in false signals.

Step Three: Entry, Stop Loss, and Take Profit

For bullish breakouts, traders enter buy positions above the upper band. For bearish breakouts, sell entries are placed below the lower band. Stop losses are commonly set inside the squeeze range, while take profit targets can be based on recent swing highs or risk-to-reward ratios.

Best Timeframes and Markets for the Strategy

The Bollinger Bands Squeeze strategy works across multiple timeframes, but some environments are more favorable.

Recommended Timeframes

Many traders prefer the H1, H4, or Daily charts, as these reduce noise and false breakouts. Scalpers may use lower timeframes, but tight risk management is essential.

Exness offers flexible leverage, including unlimited leverage on eligible accounts, allowing traders to adjust position sizing based on timeframe and volatility.

Suitable Currency Pairs

Major currency pairs such as EURUSD, GBPUSD, and USDJPY respond well to squeeze setups due to their liquidity. These pairs are also popular among traders in demanding markets like Japan, reinforcing Exness’s reputation for stability and transparency.

Combining Bollinger Bands Squeeze with Other Indicators

To improve accuracy, traders often combine the squeeze strategy with complementary tools.

Using RSI or MACD

RSI can help confirm momentum direction after the breakout, while MACD crossovers often align with volatility expansion. This combination reduces the risk of entering false breakouts.

Price Action Confirmation

Strong breakout candles, such as full-bodied bullish or bearish candles, increase confidence. Exness platforms provide smooth chart performance, even during fast-moving markets.

Risk Management for Squeeze Trading

Because breakouts can be sudden, risk management is critical.

Managing False Breakouts

Not all squeezes lead to sustained trends. Traders should avoid overleveraging and always define risk before entering a trade. Using a fixed percentage risk per trade helps preserve capital.

For traders with smaller capital, Exness Cent accounts offer an ideal environment to test the Bollinger Bands Squeeze strategy with reduced financial exposure.

Why Trade Bollinger Bands Squeeze on Exness

Successful squeeze trading requires low spreads, fast execution, and reliable platforms. Exness meets these criteria with instant order processing, competitive trading conditions, and regulation by respected authorities such as FCA and CySEC.

Being trusted in highly regulated markets like Japan further demonstrates Exness’s commitment to transparency and execution quality.

Practice the Strategy Risk-Free

Before applying the Bollinger Bands Squeeze strategy in live markets, traders should test it thoroughly.

Practice this strategy now on a Demo Exness account – risk-free – to build confidence, refine entries, and master volatility-based trading.

Conclusion

The Bollinger Bands Squeeze strategy is an effective way to anticipate major market moves by focusing on volatility contraction and expansion. When combined with confirmation tools and disciplined risk management, it can deliver consistent results across different market conditions. With Exness providing advanced platforms, strong regulation, and flexible account options, traders are well-equipped to apply this strategy efficiently in the global Forex market.